Robo Advisors in SG: Your Gateway to Smart Investment Choices

- SG Retirement Specialist

- Jun 25, 2024

- 2 min read

Updated: Jul 29, 2024

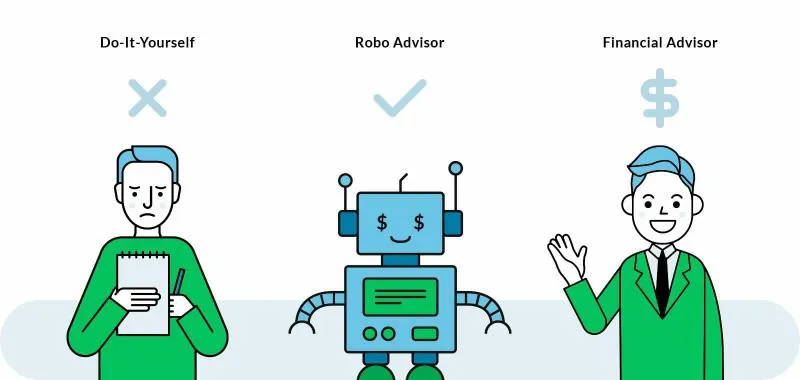

Image taken from Medium

In Singapore's bustling financial landscape, robo-advisors have emerged as indispensable tools for savvy investors.

By combining cutting-edge technology with personalized financial advice, these digital platforms offer a compelling alternative for those seeking to optimize their investment portfolios and achieve their financial goals with confidence. But what exactly are robo advisors, and how can they revolutionize your investment approach? Let's delve into the world of robo-advisors and discover why they're becoming increasingly popular among investors in Singapore.

Understanding Robo Advisors:

Robo advisors in Singapore are automated investment platforms designed to simplify and optimize your investment journey. They utilize advanced algorithms to analyze your financial goals, risk tolerance, and investment preferences gathered through comprehensive online assessments. This data-driven approach allows robo advisors to construct and manage diversified investment portfolios tailored to your specific needs.

Efficiency and Cost-Effectiveness:

One of the primary advantages of robo-advisors is their efficiency. By automating portfolio management tasks that traditionally require human intervention, they reduce costs and minimize emotional bias in decision-making. This results in more objective investment decisions aligned with your long-term financial objectives.

Diversification and Risk Management:

Robo advisors employ modern portfolio theory principles to create well-balanced portfolios. They spread investments across various asset classes such as stocks, bonds, and exchange-traded funds (ETFs) to optimize returns while managing risk. Continuous monitoring and automatic rebalancing ensure that your portfolio maintains its intended asset allocation over time.

Accessibility and User-Friendly Platforms:

Unlike traditional financial advisors, robo-advisors typically have lower minimum investment requirements, making them accessible to a wider range of investors in SG. They provide intuitive online platforms where you can easily monitor your investments, track performance, and make adjustments as needed, all from the convenience of your computer or mobile device.

Advanced Features and Customization:

Beyond basic portfolio management, many robo-advisors offer advanced features like tax-loss harvesting and socially responsible investing options. Tax-loss harvesting involves strategically selling investments at a loss to offset taxable gains, potentially reducing your overall tax burden. Some platforms also cater to specific investment preferences, allowing you to align your portfolio with ethical or environmental values.

Future Outlook and Growth Potential:

The robo-advisory industry in SG is experiencing rapid growth, driven by technological advancements and increasing investor demand for efficient, transparent investment solutions. As these platforms continue to evolve, they are expected to offer even more sophisticated services and customization options, further enhancing their appeal to investors seeking smart, automated investment strategies.

Conclusion:

Robo advisors represent a paradigm shift in investment management, combining technology with financial expertise to empower investors in SG. Whether you're new to investing or looking to optimize your portfolio, robo-advisors provide a convenient, cost-effective solution to navigate the complexities of the financial markets with confidence. Embrace the future of investing with robo advisors and embark on your journey towards financial success in Singapore.

Contact us now to discover how robo-advisors can revolutionize your investment strategy in Singapore. Whether you're a beginner or a seasoned investor, our expert team is ready to guide you toward financial success.

References: Tan, D. (2021, December 14). Robo-Advisors: An Unforeseen Emerging Market Explosion. Medium. https://medium.com/iveyfintechclub/robo-advisors-an-unforeseen-emerging-market-explosion-1e2f3e46c2c3

Team, I. (2024b, February 26). What Is a Robo-Advisor? Investopedia. https://www.investopedia.com/terms/r/roboadvisor-roboadviser.asp

Comments