Guide to Investing for Early Retirees: Start Building Your Financial Future Today

- SG Retirement Planning

- Jun 21, 2024

- 2 min read

Updated: Jul 29, 2024

Early retirement presents an opportunity to explore new horizons and secure your financial future through strategic investments.

Find out how retired individuals in Singapore can start their investment journey with assurance.

Understanding Investment Opportunities:

For early retirees in Singapore, investing wisely is key to sustaining financial independence and achieving long-term goals. Investment options abound, ranging from stocks and bonds to real estate and mutual funds. Each avenue carries its own risk and returns potential, catering to different investment preferences and risk tolerances.

Setting Financial Goals:

Before diving into investments, define your financial objectives. Whether it's generating passive income, funding travel adventures, or preserving wealth for future generations, clear goals provide direction and motivation. Align your investment strategy with these goals to optimize returns and minimize risks.

Risk Management Strategies:

Investing inherently involves risks, but early retirees can mitigate them through diversified portfolios. Spread investments across various asset classes to reduce exposure to market fluctuations. Consider balancing high-risk, high-reward investments with more stable options like bonds or cash equivalents to maintain financial stability.

Tax-Efficient Investing:

In Singapore, understanding tax implications is crucial for maximizing investment returns. Explore tax-efficient investment vehicles such as the Supplementary Retirement Scheme (SRS) or CPF Investment Scheme (CPFIS). These options offer tax benefits and incentives, enhancing your investment growth and optimizing your retirement income strategy.

Investment Strategies for Early Retirees:

Early retirees benefit from tailored investment strategies that align with their unique financial situations and retirement timelines:

Long-Term Growth: Invest in diversified portfolios that prioritize growth over time, leveraging the power of compounding to build substantial wealth.

Income Generation: Focus on investments that generate regular income streams, such as dividend-paying stocks or rental properties, to support ongoing expenses during retirement.

Capital Preservation: Safeguard wealth by allocating a portion of investments to stable assets like bonds or money market funds, ensuring financial security amidst market volatility.

Embracing Technology and Resources:

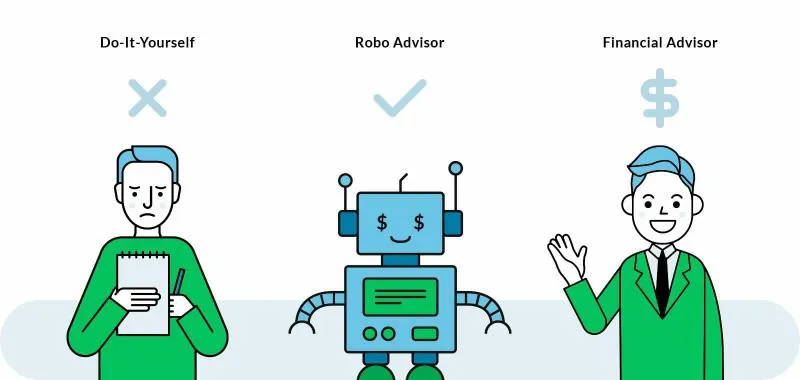

Harness digital tools and resources to streamline investment decisions. Online platforms offer access to real-time market insights, investment analysis, and portfolio management tools. Stay informed about market trends and economic indicators to make informed investment decisions aligned with your financial goals.

Seeking Professional Advice:

Consulting with a financial advisor specializing in retirement planning can provide invaluable guidance. Advisors offer personalized strategies, investment recommendations, and ongoing portfolio reviews tailored to your retirement objectives and risk tolerance. Leverage their expertise to navigate complex financial landscapes and optimize your investment strategy effectively.

Conclusion:

Investing as an early retiree in Singapore opens doors to financial independence and lifestyle flexibility. By understanding investment opportunities, setting clear goals, managing risks, and leveraging tax-efficient strategies, early retirees can build a robust financial foundation for a rewarding retirement journey. Start your investment journey today with SG Retirement Planning to secure a prosperous future and enjoy the freedom that early retirement offers in Singapore.

References: Fidelity International. (n.d.). https://www.fidelity.com.sg/beginners/investing-for-retirement/income-in-retirement Investment Options to Generate Income in Retirement | U.S. Bank. (2024, June 17). https://www.usbank.com/retirement-planning/financial-perspectives/investment-options-to-generate-retirement-income.html#:~:text=A%20diversified%20bond%20portfolio%20that,provide%20cash%20flow%20in%20retirement.

Comments